Because the sale of digital belongings elevated with the cryptographic token sort NFT, it turned out that many patrons and sellers have been unaware that they’d to pay hefty taxes after their purchases.

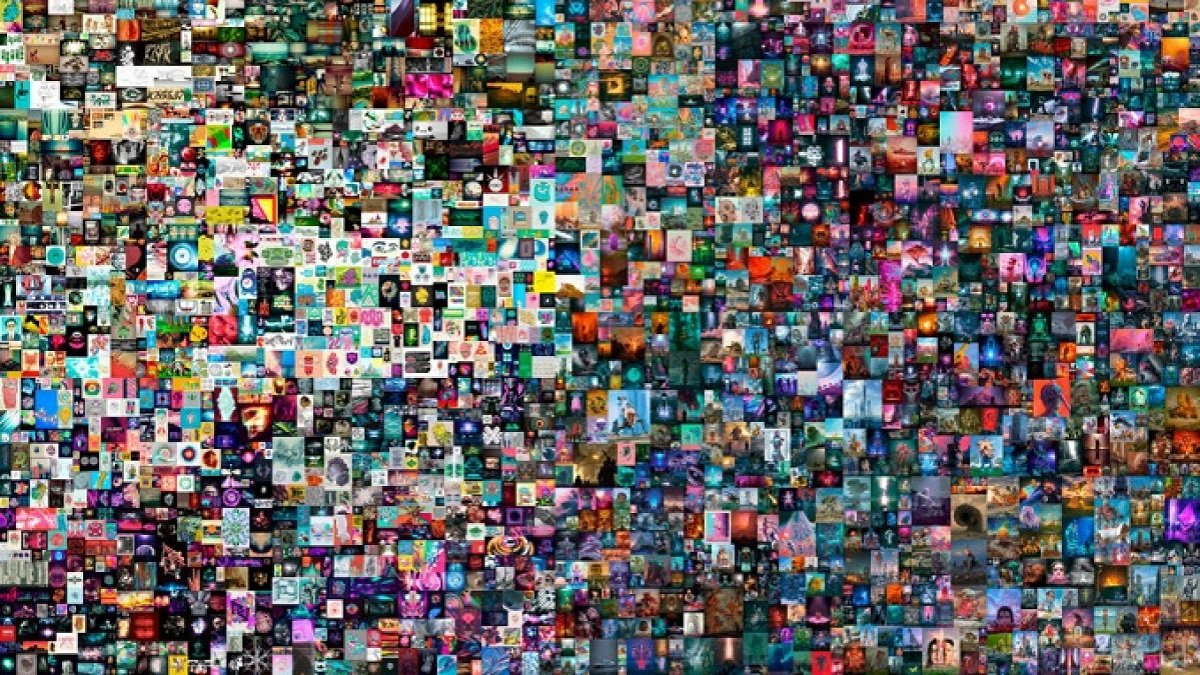

The digital paintings named ‘Everydays: The First 5000 Days’, created from the drawings made by digital artist Mike Winkelmann, often known as Beeple, over 5,000 days, broke a file by promoting for $69.3 million at Christie’s Public sale Home in London.

Studying that he had to pay greater than 10 million {dollars} in tax after the sale of his work, Winkelmann expressed his shock on his Twitter account. “Oh my god, that is an excessive amount of” introduced in his phrases.

Wikelmann’s shock additionally revealed the lack of understanding of patrons and sellers relating to the taxation of NFTs.

Properly, is there a tax on NFT works, how a lot?

DOES NFT WORKS HAVE TAXES, HOW MUCH?

The U.S. Inner Income Service (IRS) is topic to capital positive factors tax as a result of it treats the buying and selling of NFTs as funding positive factors. NFTs are taxed as excessive as 28% as a result of they’re thought-about collectibles. NFT patrons and sellers additionally want to pay attention to how the cryptocurrency they use to buy NFT might be taxed.

Most crypto artworks are bought utilizing digital currencies. Cryptocurrencies are additionally topic to a capital positive factors tax primarily based on how a lot they’ve gained since they have been bought and how lengthy the customer holds the digital foreign money.

If the customer holds the cryptocurrency for multiple 12 months, it’s topic to a long-term capital positive factors tax. Lengthy-term capital positive factors are taxed at 15% for these incomes between $40,000 and $441,000, and at 20% for these incomes extra.

Those that maintain their digital belongings for lower than a 12 months fall into the short-term capital positive factors class.

On this case, NFT patrons and sellers; They’ve to pay excessive taxes when shopping for an NFT utilizing digital foreign money, promoting their NFT for one more NFT, promoting an NFT for a cryptocurrency, and likewise changing the cryptocurrency used to purchase the product and promote it again to the US.

Shehan Chandrasekera, head of tax technique at CoinTracker, informed CNBC; He mentioned that many individuals might be stunned at tax time when it comes to the rising NFT market, and that most individuals working on this area are in all probability not conscious of the heavy tax payment they are going to face.

‘NOT AVAILABLE YET FOR OVERSEAS INVESTORS’

Talking to CNBC, tax consultants additionally mentioned that this rule within the US doesn’t but apply to abroad traders:

“For instance, the customer of the $69 million Beeple NFT offered at Christie final week makes use of the pseudonym Metakovan and is in Singapore. Since Singapore doesn’t have a capital positive factors tax, Metakovan is not going to pay taxes. He might have owed greater than $10 million in capital positive factors taxes.”

#tax #NFT #works #Tax #shock #digital #artists

Dikkat: Sitemiz herkese açık bir platform olduğundan, çox fazla kişi paylaşım yapmaktadır. Sitenizden izinsiz paylaşım yapılması durumunda iletişim bölümünden bildirmeniz yeterlidir.

https://m.ensonhaber.com/teknoloji/nft-eserlerin-vergisi-var-mi-ne-kadar-dijital-sanatcilara-vergi-soku